According to EY’s latest report on the mining sector, opportunities for mining and metals companies will continue to outweigh risks in 2022.

In brief

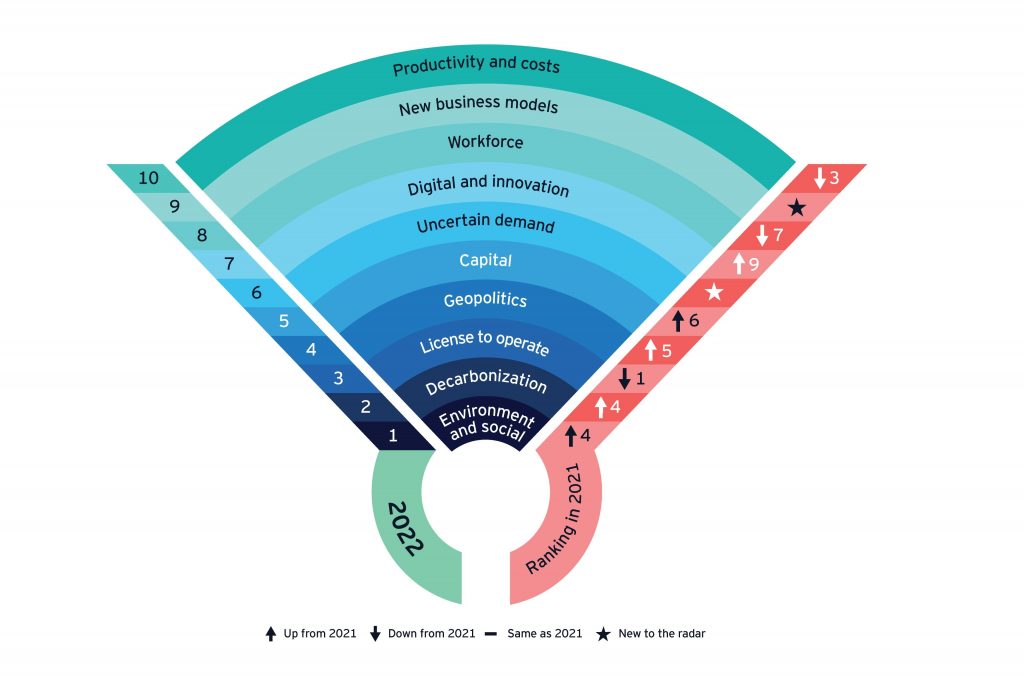

- For the first time in our annual report on the sector, mining and metals companies rank environment and social issues as their number one risk.

- Decarbonization is a major disrupter, dominating discussions and presenting both risks and opportunities.

- License to operate has lost the top spot it held for the past three years but is still seen as a top three risk.

Disruption is fast reshaping the mining and metals sector’s perception of where the biggest challenges – and paths to growth – may lie, according to our annual review of risks and opportunities in the global mining and metals sector (pdf). The climate crisis and rising stakeholder expectations are increasingly significant forces of change. Environment and social took the number one spot in our rankings for the first time, followed by decarbonization and then license to operate (LTO), which had held the top position over the past three years.

Two new entrants to the ranking – uncertain demand and new business models – highlight the ongoing volatility in a market still impacted by the COVID-19 pandemic. Still, we see more opportunities than risks for miners willing to make the transformational changes that can drive long-term value for organizations and the communities they serve.

Trend 1: Environment and social

Miners that can demonstrate their contribution to a sustainable future will have a competitive advantage.

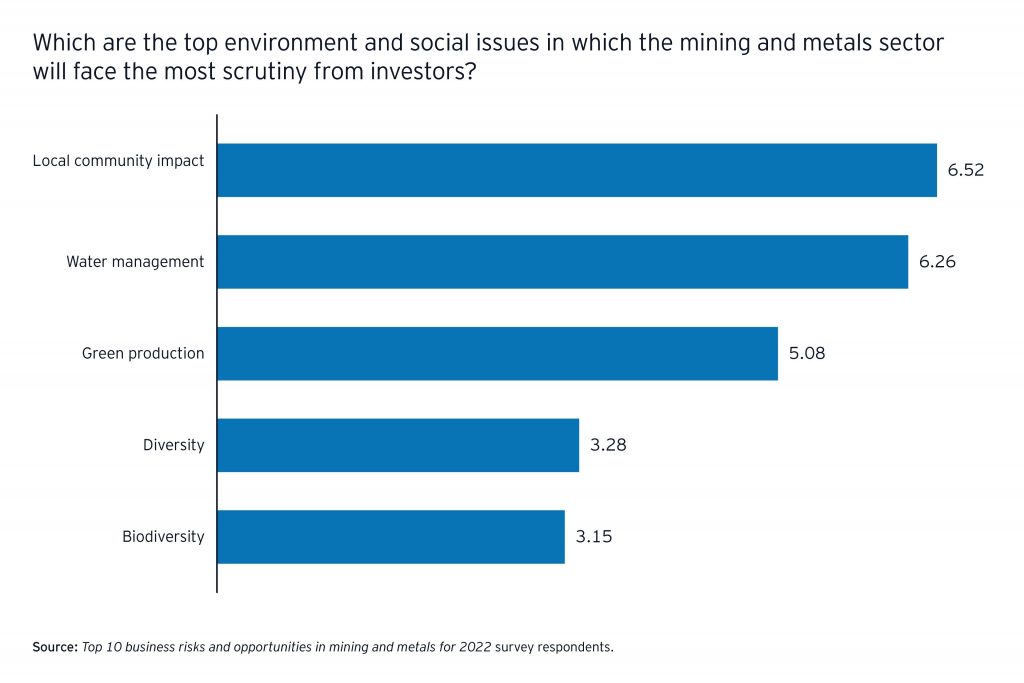

As environmental, social and governance (ESG) factors become a bigger priority for investors, shareholders and a broader group of stakeholders, miners are doing more to integrate ESG into corporate strategies, decision-making and stakeholder reporting. Stakeholder pressure over issues such as biodiversity and water management are likely to intensify, requiring miners to progressively plan for mine closures and better manage the water-energy nexus to satisfy expectations.

Companies are also under increasing pressure to take more responsibility for their impact on communities, and go beyond their regulatory obligations. Miners that help drive the long-term, sustainable economic and social growth of the regions in which they operate can leave a positive legacy beyond life of mine.

Trend 2: Decarbonization

Building a flexible decarbonization strategy can help achieve net zero and differentiation.

With investors and governments moving away from investment in thermal coal, and carbon pricing set to increase, miners must treat decarbonization like any other strategic risk.

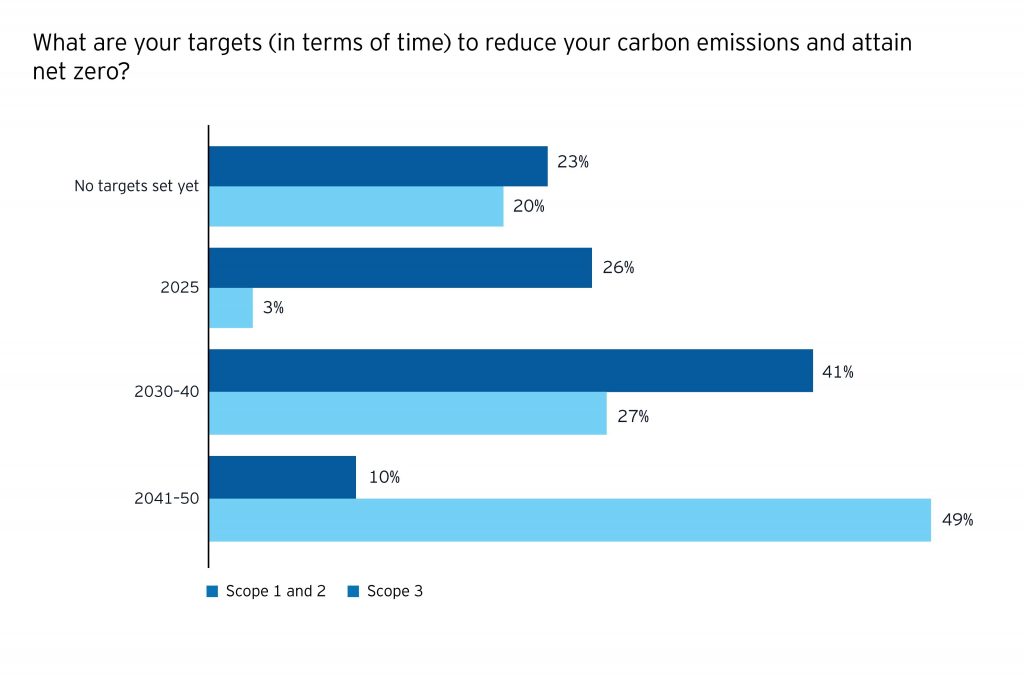

Building a flexible path to decarbonization, which includes scenario modeling and reviewing funding, technology and assets, can help companies achieve net zero and differentiate. And while many companies have made progress in abating Scope 1 and 2 emissions, now is the time to focus on Scope 3. Those that can control these emissions can create genuine value and long-term sustainability.

Seguir leyendo la noticia en la fuente original

Fuente: Ernst & Young